A new 28% tax levy applied to all deposits to online gambling sites operated by companies in India spells the end of domestic iGaming firms in the country. (Photo by Pranav Choubey on pexels.com)

In a huge blow for operators, a confusing 28% tax rule has hit the iGaming, eSports, and online sports betting industry in India.

Never have we seen a figure like this taxing gambling. Although there are companies in India that pay high tax revenues in other industries, the online gambling levy is outlandishly high in comparison. On top of this, the rules on this tax lavvy are mind-boggling.

The consensus I have picked up on is there is a double whammy for players here.

- When players deposit, the 28% Gross GST tax levy is deducted

- When players win, there is a 30% tax in winnings

Furthermore, information released thus far suggests that all games or sports regardless of skill or chance will qualify for the tax. That means if you can place a bet and it is online, then the 28% tax applies.

What is the alternative? There is no alternative for gambling businesses operating in the country. However, for players, they can head to overseas casinos.

Will overseas casinos become the preferred choice for India’s gambling population?

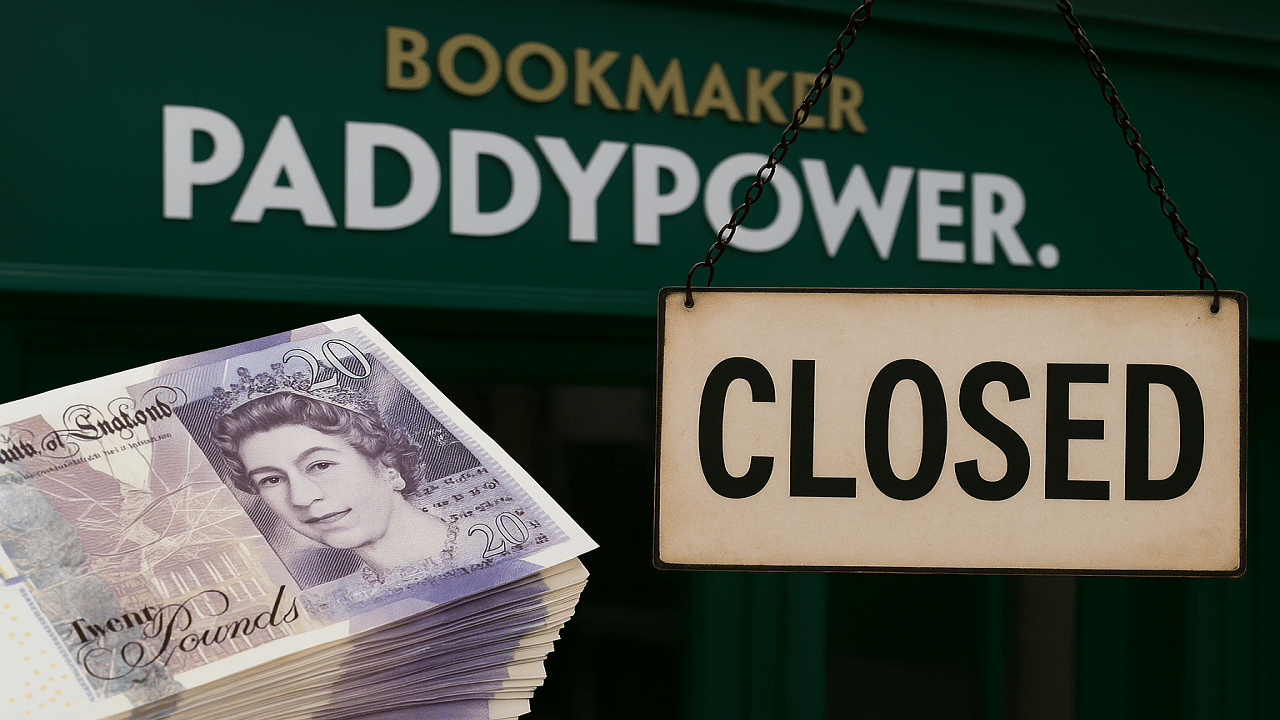

Here’s the issue gambling companies in India face. Players will not want to play at online casino sites or any other online gambling website operated by a business in India.

Here is why:

- Deposit: If you deposit ₹ 100,000 rupee, your starting balance is ₹ 72,000

- Tax on winnings: If you win ₹ 72,000 doubling your money to ₹ 144,000 rupees you pay a 30% tax levy on this too. That’s ₹ 43,000 leaving you with ₹ 101,000

- The result: Tax paid is ₹ 71,000

Here’s the problem for operators in India…

- There are 100s of top gambling sites in India operated by companies in Malta, Cyprus, Curacao, and other countries. Many of them will not enforce the 28% levy. In fact, the T&Cs clearly state tax obligations are down. Players will head to these casinos.

- Operators with an online gambling business based out of India cannot compete with these companies. Who would want to deposit and start gambling with a 28% deficit. Therefore, overseas casinos are the obvious option.

Pushing problem gambling away: The biggest issue created is India’s government will lose its ability to control problem gambling. If no one want to play at domestic online casinos, controlling gambling addiction in a black market is impossible.

Is there foul play involved?

A 28% tax levy, in my opinion, stinks of foul play or is it simply ignorance? One thing is for sure, those that pushed the tax levy forward are inward focused. Either through self-interest or they just don’t see the bigger picture. They clearly have learnt nothing from other jurisdictions around the world.

Where the blame lays is a mystery, but there are one or two scenarios:

- Lobbying by land-based gambling brands: The land-based casino industry may well have played a role in the government’s decision. Yet, I cannot be sure. It would not surprise me if a subsequent private investigation could reveal connections with government officials and retail gambling brands in the country.

- An influential figure: Another possibility is an influential figure who has personal issue with online gambling or gambling as a whole has pushed the high tax levy agenda forward.

- Pure Stupidity: A simpler explanation could just those that pushed through a 28% levy are simply disconnected from reality. India wouldn’t be the first country to show such foolishness. The UK and Germany are great example. However, even these two countries have not come up something as ridiculous as a 28% tax levy.

Is this the end? What do you think? Is the 28% tax levy the end of domestic online gambling companies in India? Personally, I am 99% sure this is the end. Players will now look to overseas casinos.

A new regulatory authority is now a waste of taxpayers money

Even more worrying is the fact that taxpayers’ money has been used to research the creation of a regulatory authority in India. What a waste because with the current taxes in the country, there will be no domestic companies to tax or regulate.

What is next? No operator or gambling company will want to invest in India’s online gambling now. The new tax law makes certain of that. It is now an industry ripe and ready for overseas casinos to take over.

Leave A Comment