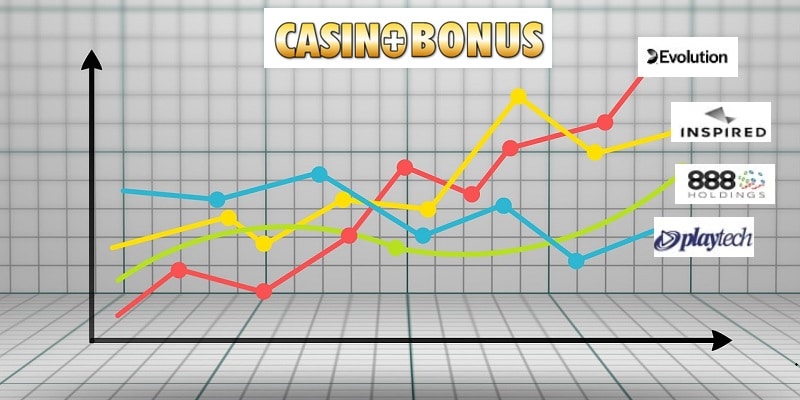

From the 2024 stock market opening, iGaming share price movement is as follows: PTEC.L (+8.89%), ALL.AX (-1.67%), LNW (+13.94%), 888.L (-4.34%), EVO.ST (-0.85%), INSE (-12.91%), FLTR.L (+12.71%), and MGM (-7.34%). (Image by Mohamed Hassan from Pixabay)

We are back with what is now a monthly report covering gambling share prices across the globe—and some surprising news. Before we get into the nitty-gritty details of stock price movements, we have a new player on the NYSE stock market to report.

Games Global to go public

Games Global is an online gaming content developer for the iGaming industry that has registered with the Securities Exchange Commission (SEC) in the U.S. and filed an initial public offering (IPO) for the NYSE.

The company, which bought out Microgaming’s game delivery system and portfolio, will be listed under the ticker GGL. According to reliable sources, the IPO will be managed by lead underwriters JP Morgan, Jeffries, and Macquarie Capital. Cooley LLP assists them with SEC compliance laws. When writing, GGL did not state the number of shares on offer (or the listing price) or the IPO date.

After purchasing the Digital Gaming Corporation last year, the company has had great success penetrating the U.S. market. It has increased its revenue from USD 194m in 2022 to $327m in 2023. Games Global’s 82% revenue growth is attributed to USD 15.2m in pre-tax profits in the same period.

Games Global has over 40 in-house/partnered studios that are backed with exclusive rights to over 1,300 proprietary games. The company is known in the industry for its slot games, but its portfolio includes table games, video poker, video bingo, and progressive jackpots. The company also hosts crash games, a form of gambling where players have a set amount of time to place a bet on a rapidly changing multiplier. The odds increase until the growth multiplier randomly crashes. The player will have to cash out before this random crash occurs.

The public offering will be available to European investors to meet the requirements of the EU 2017/1129 statute of the Prospectus Regulations for the European Economic Area. UK investors can also buy shares under the same adopted laws (EEA) if they fulfill the qualified investor requirements. According to a Market Watch report, the Games Global IPO value is about $2 billion.

Previous Gambling Company Share Price Reports: The last time we produced a gambling stock report was April 11, so we have to close to one month’s worth of price changes to report. You can recap on the previous price performances via the ‘Gambling Share Prices 2024 – Issue 7‘ update.

Gambling Company Price Movements

London Stock Exchange (LSE)

Playtech – (PTEC.L)

- Playtech released their new live game show, Super Mega Ultra, in partnership with bet365 last weekend across the UK, Ontario and Mexico. The live game immerses the players in the wheel-based game by offering 3 wheels that feature 3 different payouts – Super, Mega & Ultra. The players can level up after each spin with a maximum multiplier of x2500 (Ultra). Game releases don’t have a major effect on stock prices, but PTEC is slightly up on our previous report when it was valued at 454.00 GBX, while it closed trading yesterday valued at 485.00 GBX, marking a +6.83% rise since 11 April 2024. Playtech is still down since its 2023 bull run, but only by -4.24%, so it could easily rally back to its previous highs of 600+ GBX seen in 2023 when there was plenty of hype about Aristocrat Leisure Limited buying the company, which will please bulls. Meanwhile, the Bears are probably looking to shorten the company’s good fortunes, as PTEC isn’t well-known for maintaining its high points.

Current Price: 485.00 GBX

2 Jan 2024 Open: 445.40 GBX

(+39.60 GBX | +8.89%)

3 Jan 2023 Open: 506.50 GBX

(-21.50 GBX | -4.24%)

Australian Securities Exchange (ASX)

Aristocrat Leisure Limited – (ALL.AX)

- The Australian gaming giant Aristocrat has received regulatory approval to acquire Luxembourg-based NeoGames. The 1.2b USD purchase of NeoGames will still need 61% approval of their shareholders… the shareholders agree to the acquisition. ALL shares bounced 2 AUD on the announcement and closed on Friday, worth 39.92 AUD. It’s been slightly down since the last report’s 41.15 AUD valuation, losing -2.99% on its 11 April 2024 closing price. This puts the company’s stock price in the red since its 2 January opening price.

Current Price: 39.92 AUD

2 Jan 2024 Open: 40.60 AUD

(-0.68 AUD | -1.67%)

3 Jan 2023 Open: 30.66 AUD

(+9.26 AUD | +30.22%)

(Nasdaq Stock Market)

Light & Wonder – (LNW)

- Light & Wonder continues to expand its portfolio by recently partnering with Evoplay in Europe and Bragg Gaming Group throughout Europe and the U.S. LNW will distribute games and content to showcase their aggregation platform on a global scale. The company’s new content agreements will continue LNW to deliver exciting new titles to the market and advance studios to a higher level. On 11 April 2024, the stock was worth 96.72 USD per share but has dropped off -3.92% to 92.93 USD at the end of trading yesterday. However, its performance since 2023 has been remarkable, showing the kind of increases we see in our cryptocurrency reports, while it continues to rise in 2024.

Current Price: 92.93 USD

2 Jan 2024 Open: 81.56 USD

(+11.37 USD | +13.94%)

3 Jan 2023 Open: 56.95 USD

(+35.98 USD | +63.19%)

London Stock Exchange (LSE)

888 Holdings – (888.L)

- The plagued 888 Holdings has stated that it will change its name to “evoke.” The CEO wants to shed a year of upheaval, which has had an adverse effect on its share price. The name change reflects a strong multi-branded company with a new vision/mission to the gaming public. The company will also set new financial goals to increase revenues and reduce debt from the purchase of William Hill in 2021. On 11 April 2024, 888 Holding closed at 83.90 GBX but has since recovered +3.75%. 888 Holding has been in the green since 2023’s market opened, but 2024 shares don’t seem to be able to push into the green, and we are in month five already. Will we see a push or drop-off in the coming months?

Current Price: 87.05 GBX

2 Jan 2024 Open: 91.00 GBX

(-3.95 GBX | -4.34%)

3 Jan 2023 Open: 84.60 GBX

(+2.45 GBX | +2.90%)

(Nasdaq Stockholm)

Evolution AB – (publ) (EVO.ST)

- Evolution (EVO) – The share price of Evolution has fluctuated wildly in the last 2 weeks. Market analysts have shared that the company has been in a substantial short selling pattern since mid-March. EVO was looking like it was proving the market makers wrong when it was up marginally, trading at 1,321 SEK at the end of April, but coming into May the stock price has dropped off now priced in at 1,207 SEK. Since our last report, it is now down -6.80%, and has fallen behind its 2024 market open price, but still remains in the green since 2023.

Current Price: 1,207 SEK

2 Jan 2024 Open: 1,217.40 SEK

(-10.40 SEK | -0.85%)

3 Jan 2023 Open: 1,028.00 SEK

(+179.00 SEK | +17.41%)

(Nasdaq Stock Market)

Inspired Entertainment, INC – (INSE)

- Troubled Inspired Entertainment posted its Q4 2023 results on April 15th. The company was in line with market expectations, with 12% yearly growth in EBITDA. The lack of growth has been attributed to limited gains in market share, but the company stated that new products and territorial expansion is the focus of their strategy for 2024. The company will enter the Brazilian market in Q1 and aging product cabinets. The stock closed yesterday at 8.57 USD and continues its’ bearish trend, with weak support at 8.47 USD. In our ‘Gambling Share Prices 2024 – Issue 7 Update’, the stock was valued at 9.82 USD, making this a -12.73% over 23 days. Its 2024 and 2023 market open prices versus its current 8.57 USD valuation continue to flounder. Could we see a buyout coming soon?

Current Price: 8.57 USD

2 Jan 2024 Open: 9.84 USD

(-1.27 USD | -12.91%)

3 Jan 2023 Open: 12.85 USD

(-4.28 USD | -33.31%)

London Stock Exchange (LSE)

Flutter Entertainment plc (FLTR.L)

- Flutter announced today that they will release their Q1 2024 financial results on May 4th. FLUT share bounced almost 2% on the news, as analysts expect 30% growth in core profits because of aggressive expansion in the U.S. The company also forecasted that they expect a 17.7% increase in revenue for full year 2024. The share price dropped sharply at the end of March and throughout the beginning of April, but looks to be making a comeback closing on Friday at 15,705 GBX. It’s not much, but its up from 15,700 GBX on 11 April 2024 by 5 GBX, which is a mere +0.03%. Overall, Flutter Entertainment plc is still performing well in 2024 and +37.71% up since its 2023 market open, so it’s still looking rosy.

Current Price: 15,705.00 GBX

2 Jan 2024 Open: 13,935 GBX

(+1,770 GBX | +12.71%)

3 Jan 2023 Open: 11,405 GBX

(+4,300 GBX | +37.71%)

New York Stock Exchange (NYSE)

MGM Resorts International (MGM)

- The cyber attack that affected MGM Resorts for 10 days last September and the ensuing losses continue to trouble the company. The company lost an estimated $100m USD in revenue and millions more rebuilding their IT network. MGM has filed a lawsuit against the Federal Trade Commission (FTC) for demanding information regarding the cyberattack. The lawsuit has refocused on MGM and now… the FTC Chairwoman, Lina Khan, who was a guest at the hotel during the attack. MGM wants Ms. Khan to recuse herself from the case because she would have been directly affected by the attack and have a conflict of interest. MGM believes that the FTC has “ulterior motives” for the investigation… none of which relate to the cyberattack. The share price of MGM closed yesterday at 41.04 USD, down -3.75% since our previous report on 11 April 2024. For the time being, MGM looks to be in a bearish trend with only a slight glimmer of hope of improving. On a positive note, it is still +21% up on its 2023 market open price.

Current Price: 41.04 USD

2 Jan 2024 Open: 44.29 USD

(-3.25 USD | -7.34%)

3 Jan 2023 Open: 33.93 USD

(+7.11 USD | +20.97%)

Disclaimer: We are not stock market professionals. We merely report the facts and do not ecourage making any invest decisions off the back of the unformation provided in this report. For advice from those that specialise in stock market trading please visit a pro trading platform and research the latest financial news from source such as Investopdia, Marketwatch, and Yahoo Finance.

Leave A Comment