UK banks offer customers gambling transaction-blocking tools & GamCare wants them to make more effort in increasing customer awareness. (Image by Gerd Altmann from Pixabay)

One of the staunchest advocates of gambling awareness and responsible gambling in the UK and on the global online gambling entertainment stage is GamCare. And the non-profit is on yet another march to help players understand the tools available to them when it comes to safer gambling practices.

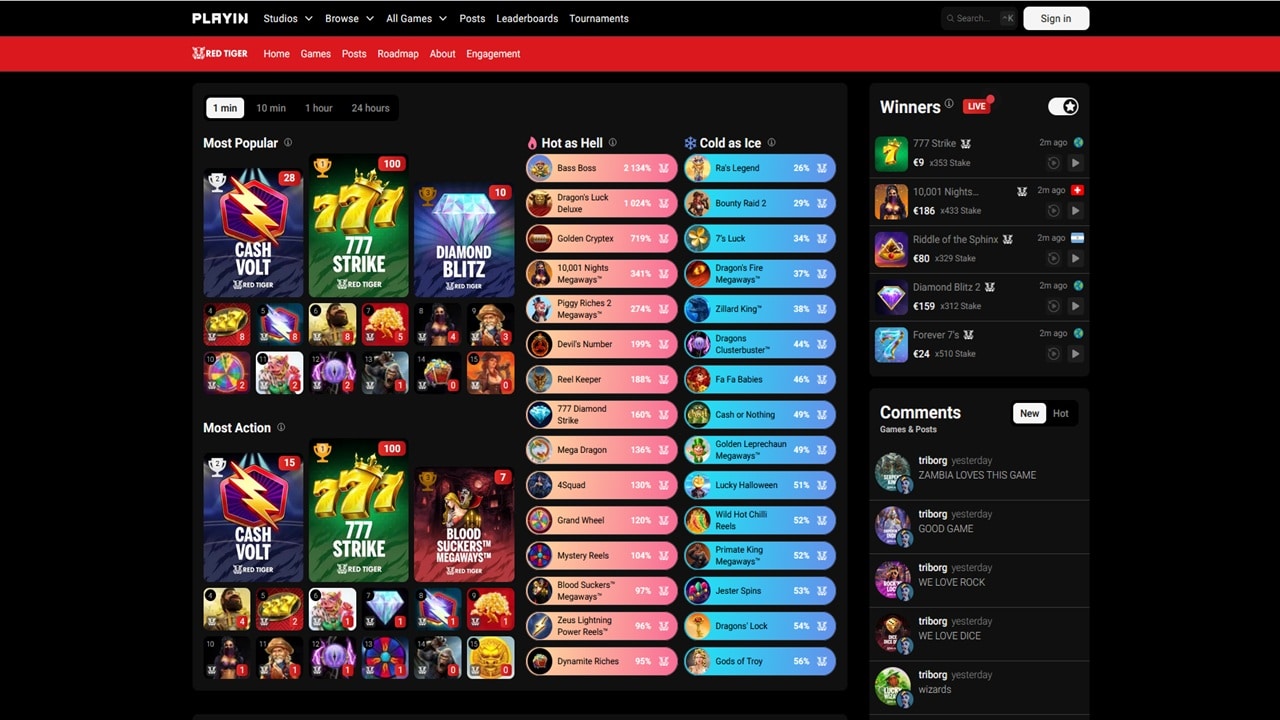

In the latest push for a safer UK gambling market, GamCare is asking banks to create campaigns that make customers aware of gambling block tools available. The move comes off the back of banks implementing these gambling transaction blocks over the last two years or so.

Now that banks have moved to take more responsibility in the fight against gambling addiction, GamCare wants them to go the extra mile. The issue is that many customers of these banks are unaware that gambling block tools exist.

I have lived in the UK for a long time, and I must admit I don’t know if my UK bank account offers this facility. There may have been an email at some point, but I rarely read updates to services from any of my banks. After checking my HSBC UK account, it turns out the gambling tool does exist, but only because I looked at the main website through a web search.

UK Credit Card Ban on Gambling: Did you know that banks in the UK not only offer gambling block service but will also not process credit card transactions for gambling deposits?

GamCare’s Efforts to Help Problem Gamblers Control Their Gambling

The implementation of gambling block options for UK banking customers comes as part of a campaign called the Gambling Related Financial Harm (GRFH). Under the GRFH, there are services such as the TalkBanStop, which is a system brought forward through a collaboration across GamCare, Gamban, and Gamstop.

The trio promote and provide free tools and resources for gamblers to manage or stop their gambling activities. All three organisation additionally provide support through counseling services, software that blocks access to gambling sites and mobile applications, and self-exclusion databases. The latter means that when players self-exclude from a UK gambling website, that self exclusion propagates to all gambling establishments land-based and online so players can’t simply switch sites after a ban.

Responsible Gambling Tools: All UK online casinos must implement GamCare as part of their self-exclusion tools. You will also find that these casino platforms as well as those on the Malta Gambling Authority (MGA) licensing provide tools to set deposit, loss, and stake limits. You will find that each of our online gambling site reviews here mentions whether the site provides responsible gambling tools or not.

Inconsistent Naming Conventions of Gambling Blocks in Banking Apps

Deelan Maru, a counsellor from the Behavioural Insights Team, raised an issue concerning the diverse naming conventions used for gambling blocks in different banking apps. The inconsistency can result in uncertainty and misunderstanding for the consumers. For instance, one bank might label it as a ‘card freeze,’ while another could categorise it under ‘merchant control’ or ‘restriction’ settings.

Maru stresses the importance of presenting these tools in easily accessible locations within the apps and suggests standardisation of terminologies across the financial industry. This could aid in enhancing the recognition and utilisation of these gambling management tools.

The goal is to ensure that a larger number of vulnerable customers are safeguarded from the potential harms of gambling.

Leave A Comment